- User Stats

- Feature Comparison

- Minergate: Company Trust, Uptimes and Fund Security

- NiceHash: Company Trust, Uptimes and Fund Security

- Available Cryptos and Mining Algorithms

- Minergate Payouts and Fees

- NiceHash Payouts and Fees

- Conclusion

NiceHash and Minergate are two of the most popular cloud mining options on the market today.

We look at everything from user stats to fund security, payout fees, and more in this NiceHash vs. Minergate comparison article.

User Stats

Minergate receives around 2,000 signups per day on average. Over 500,000 miners have reportedly profited from using the site. This platform is used by around 3,700,000 miners worldwide. Meanwhile, in January 2019, NiceHash has more than 303,000 daily active workers, 101,000 miner users, 4,168,000 orders and 195,000 BTC in payouts.

Feature Comparison

Bother Minergate and NiceHash allow you to turn on automated algorithm switching. This provides you with a solution for finding the most profitable coin to mine in real-time.

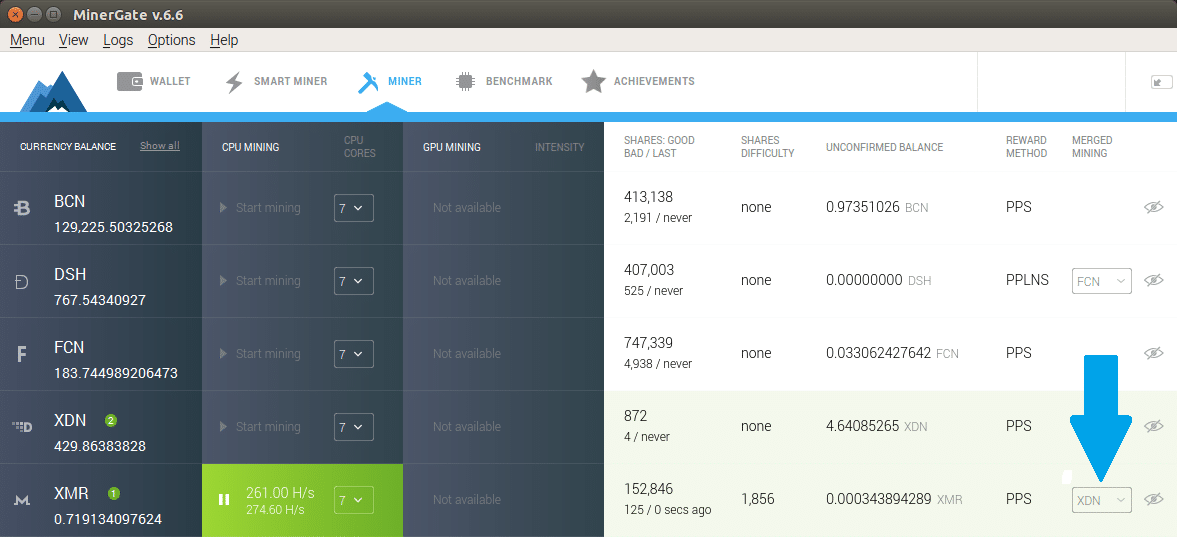

Minergate has several different options for merged mining. In June 2014, MinerGate became the first CryptoNote pool that features merged mining. In October 2016, Minergate added this functionality for mining XRM, XDN and FCN simultaneously. This is due to the fact that all use the CrytoNight algorithm. As of January 2019, NiceHash doesn’t offer any merged mining options.

Minergate: Company Trust, Uptimes and Fund Security

Even though it’s easy enough to download and run the software, Minergate has had a few users complain about a number of issues. For example, some have claimed they were not able to withdraw funds or couldn’t see available funds on their accounts. Additionally, a number of reviews online attach affiliate links to the Minergate website. While the latter doesn’t equate it to a scam necessarily, it does make it slightly less trustworthy.

Some users also say that Minergate is not transparent about hash rates. For example, reviewers state that Minergate lists a lower hash rate for your device than what it actually should be. Effectively, this means that Minergate allegedly takes potential earnings off the top. Despite the existence of these issues, some users have also reported success stories of using the platform.

Minergate does have 99.97 percent uptime, which is quite good. For fund security, it utilizes Google two-factor authorization. All coins mined are pure coins, which means that they come directly from the block that is mined. This possibly makes it a better choice than other options that first go to a third party before transferring to your wallet.

NiceHash: Company Trust, Uptimes and Fund Security

At the end of the day, NiceHash is a third party. Therefore, there are some doubts among users about whether or not the platform can be trusted. That being said, most reviews online seem to be equally skeptical about NiceHash and Minergate. Although NiceHash does have more transparency, some trust issues still remain.

The biggest problem with fund security took place in December 2017. Back then, NiceHash was hacked, and a total of 4,700 Bitcoins (BTC) were stolen. At that time, stolen funds held a value of around $65 million. After this event occurred, NiceHash’s CEO resigned. According to a blog post from January 2019, NiceHash has returned 71 percent of stolen funds to users in twelve rounds of reimbursements. This reimbursement process is still ongoing. The investigation surrounding the hack also appears to be ongoing, even in early 2019. No platform uptime statistics are available for NiceHash.

[thrive_leads id=’5219′]

Available Cryptos and Mining Algorithms

Minergate supports Bitcoin (BTC), Bitcoin Gold (BTG), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), Zcash (ZEC), Bytecoin (BCN), Monero (XMR), Monero-Classic (XMC), FantomCoin (FCN) and Aeon (AEON).

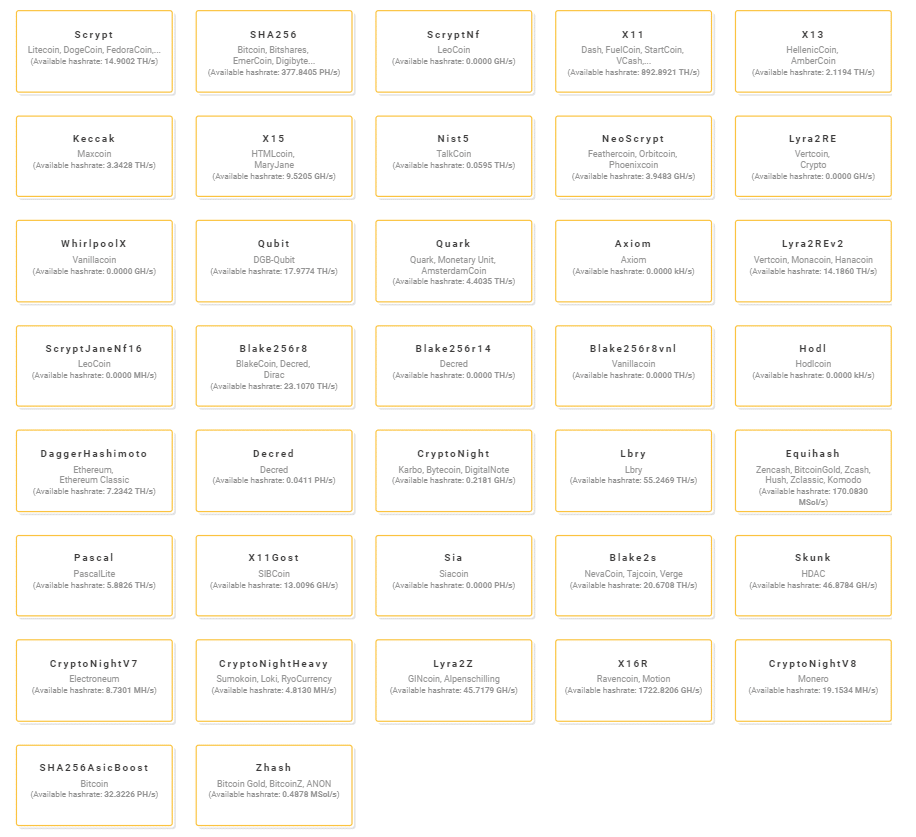

Compared to Minergate, NiceHash has a considerably higher amount of available cryptocurrencies. On its website, NiceHash lists 37 different mining algorithm options and more than 70 available coins. The minimum order price is 0.005 BTC for every algorithm. This can be viewed as both a positive and a negative. For instance, you can mine more coins but deciding to choose some lesser-known altcoins could potentially be risky or not worth the initial investment.

Minergate Payouts and Fees

Minergate allows you to withdrawal as little as 0.01 of any coin you mine on its platform. It uses two distinct payment methods: Pay Per Share (PPS) and Pay Per Last N Shares (PPLNS). For PPS, fees are 1.5 percent for LTC, BCN, XMR, XMC and AEON. All other coins have zero fees. For PPLNS, all coins have fees of 1 percent except for ZEC, which has zero fees.

Besides the fees, what are the major differences between these two payout options?

According to the Minergate website, PPLNS includes a luck factor. Using PPLNS, payout per share will have a large range (30 percent more or less on payouts). However, PPLNS earns more than PPS (by 5 percent or so) on average in the long run (a month or more).

In contrast, PPS is a more direct method where you get a standard payout rate for each share completed. This eliminates the luck in your payout but can decrease your total income per share by around 5 percent. Using PPS, you get a set number of cryptocurrencies per share of work you have solved. Since no luck is involved, the payouts don’t fluctuate.

In essence, PPS is for people who want to mine faster and earn higher payouts on average. PPLNS is for miners who want to use a statistics-driven approach for upsizing mining power.

NiceHash Payouts and Fees

Unlike Minergate, NiceHash doesn’t pay out in the coins that are actually mined. For instance, if you want to mine Litecoin (LTC) or Ethereum (ETH), you can only get paid in Bitcoin (BTC). Considering the NiceHash hack of 2017, some users might not like to have this option. It’s also less inconvenient if you actually want to mine a coin and hold it directly, as you can with Minergate or other mining options. To do this with NiceHash, you would actually have to use the BTC payout and go to an external exchange. In some cases (depending on trading pair availability, liquidity, and other factors), this might mean that you have to make two trades and pay high fees just to hold a specific coin.

Although the lack of payout options is a disadvantage for NiceHash, it possibly has a big advantage over Minergate when it comes to the fee structure. NiceHash fees are more complicated yet appear to be much lower than Minergate in most scenarios. Withdrawals from 0.001 (minimum amount) to 0.1 BTC to any Bitcoin wallet, there is a fee of 0.0001 BTC. If the withdrawal is greater than 0.1 BTC to any Bitcoin wallet, the fee is 0.1 percent of the withdrawn amount. Those looking to exchange funds via Coinbase can do this quite easily. Most importantly, there is no fee for any amount sent over 0.001 BTC to a Coinbase wallet.

Conclusion

In the NiceHash vs. Minergate debate, it’s difficult to choose a clear winner. Both have unique advantages and disadvantages you should consider before signing up. When it comes to cloud mining, both are top competitors in this space and have massive user bases.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.